There are various scenarios in indian gst on different type of transactions.

Let us see how we can calculate gst on vendor that are actual not vendors in my system (i.e. Parties). The use of party was used for calculating TDS on vendors which are not vendors in my system, where we need not maintain ledgers for them. We just use them for calculating TDS. The functionality of party has not been extended for calculating gst also.

Nav 2016 CU Update 30 contains new functionality by which we can do GST transaction on general Journal. It gives us functionality by which we can book direct Invoice against Vendors also ,were there is an option by which we can do GST Transaction against Party for which No Vendor cards need to be created in the System.

Mandatory Fields need to be updated before transaction.

State Code on Parties

GST Party Type on Parties

GST Vendor Type on Parties

GST Registration Type on Parties and Location Code.

GST Registration No. on Parties.

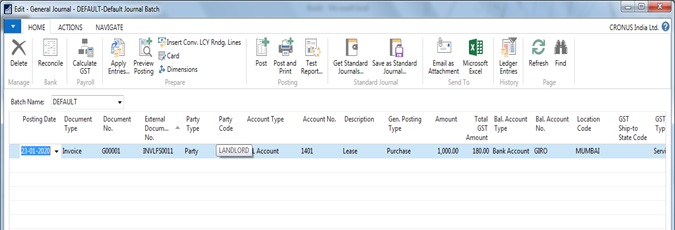

In the above scenario we can see that we had selected Party Type and Party Code for booking bill for G/L Account.

Fields which need to be filled up in General Journal for GST Transaction.

Fields Data value

Posting Date Date of posting

Document Type Document type will be Invoice

Document No. Document No.

External Document No. Vendor Invoice No.

Party Type Party Type if we are booking bill against Party

Party Code Party Code

Account Type Vendor

Account No. Vendor Acc No.

Description Description

Gen. Posting Type Purchase

Amount Transaction Amount

Total GST Amount System Calculated GST Value

Bal. Account Type

Bal. Account No. Bal. Account No.

Location Code Location Code

GST Group Type GST Group Type i.e Goods/Services

GST Group Code GST Group Code

GST Vendor Type GST Vendor Type i.e Registered or Unreg

GST Base Amount GST Base Amount

HSN/SAC Code HSN/SAC Code

GST Credit Availment or Unavailment

Exempted Exempted or not

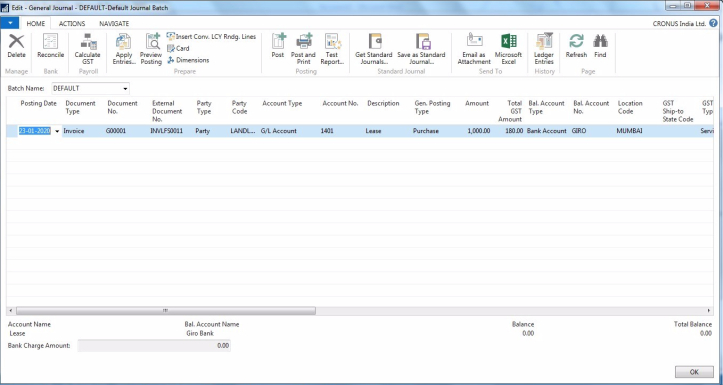

After that we have to click on Calculate GST Function on Home tab of General Journal as shown in Image below to Calculate GST for the Transaction.

Now that we have calculate GST we shall now post and check the transactions.

G/L Impact of the Transaction.

Posting Date Document Type G/L Account Name Description Gen. Posting Type Amount

23-01-2020 Invoice Lease Lease Purchase 1,000.00

23-01-2020 Invoice IGST Rcvble AccLease 180

23-01-2020 Invoice Giro Account Lease -1,180.00