Recently CU 38 has been released, and if you are upgrading from an older build of IN gst database to new build, you need to update gst related data before you start your transaction posting routine.

What updates ?

If you have updated you database then you need to get your license refreshed, just ask you partner to send in the new license.

Second thing is the menu suite, you need to import the new suite from the standard or the target database into you customised solution. After you have imported it, you need to open the menu suite in design mode and just save it. This shall reflect the new menus in your customised menu that have come up in then new CU.

Once the above is completed you need to run some batch reports.

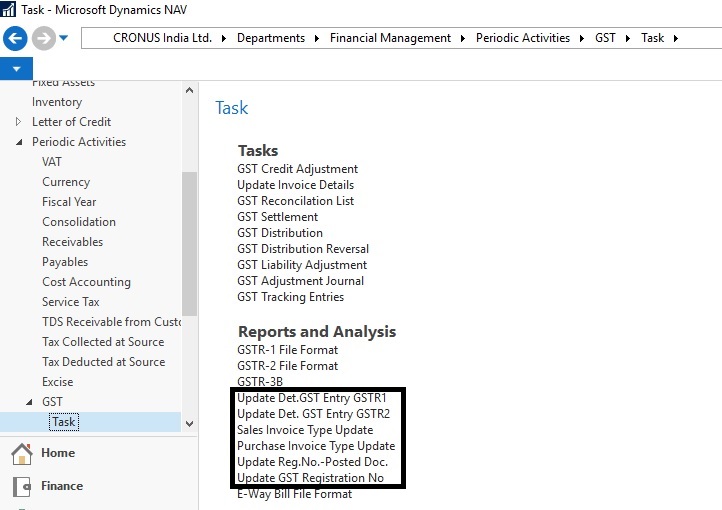

Below is the screen shot of the reports that needs to be run.

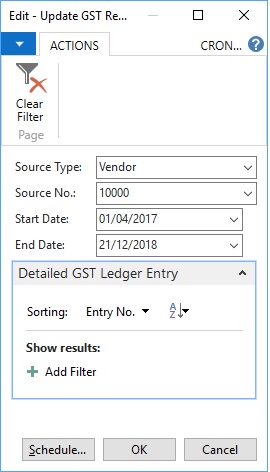

Firstly you need to run the last report :- Update GST registration No.

This shall update data as per selection of source type & source no for the specified date filter.

Purchase document (Posted / Unposted) :- Vendor GST Reg. No.

Purchase document (Posted / Unposted) :- Order Address GST Reg. No. : If order address is selected in document.

Sales Document (Posted / Unposted) :- Customer GST Reg. No.

Sales Document (Posted / Unposted) :- Ship-to GST Reg. No. : If ship to address is selected in document.

Purchase document (Posted ) :- Buyer/Seller Reg. No. : If order address is blank will insert from vendor master else will insert from order address.

Sales document (Posted) :- Buyer/Seller Reg. No. : If ship to address is blank will insert from customer master else will insert from ship to address.

Vendor Ledger :- Buyer GST Reg. No. : If order address is blank will insert from vendor master else will insert from order address.

Customer Ledger :- Seller GST Reg. No : If ship to address is blank will insert from customer master else will insert from ship to address.

2. Update Sales Invoice Type := Will Update Sales Invoice type in posted documents

3. Update Purchase Invoice Type := Will Update Sales Invoice type in posted documents

4. Update Det.GST Entry GSTR1 := This shall update data for GSTR1 (i.e. UOM,etc)

5. Update Det. GST Entry GSTR2 := This shall update for GSTR2 (i.e. Eligibility for ITC, etc)

6. Update Reg.No. Posted Doc. := Will update gst ledgers data.

There are some permission issues that you need to add in the report for updating the data.

Above updating is taken from CU35 Build.