As per the GST amendment rules, user can issue a single credit / debit note against multiple invoices, to accommodate this change in system, a new page is linked in documents and journals. User can select multiple reference invoices in this page against single credit / debit note.

Navigate to -> Departments/Sales & Marketing/Order Processing/Sales Credit Memos.

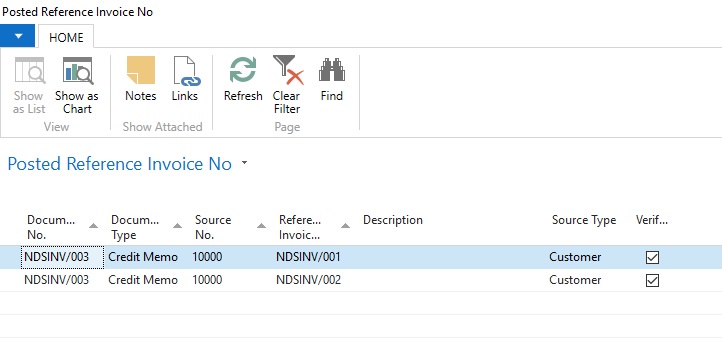

Here you will find a new button has been given to attach multiple invoice.

.jpg)

Once you click the update reference invoice no. system will open a new page where you need to tag the invoices. Drill down on reference invoice nos. and select the invocie which needs to be tagged. Once tagged you need to verify the documents tagged. On the ribbon click verify.

.jpg)

What verify does,

It checks the reference invoice nos for gst ledger entry.

Wrong invoice nos, user types in reference invoice nos insted of selecting from the lookup.

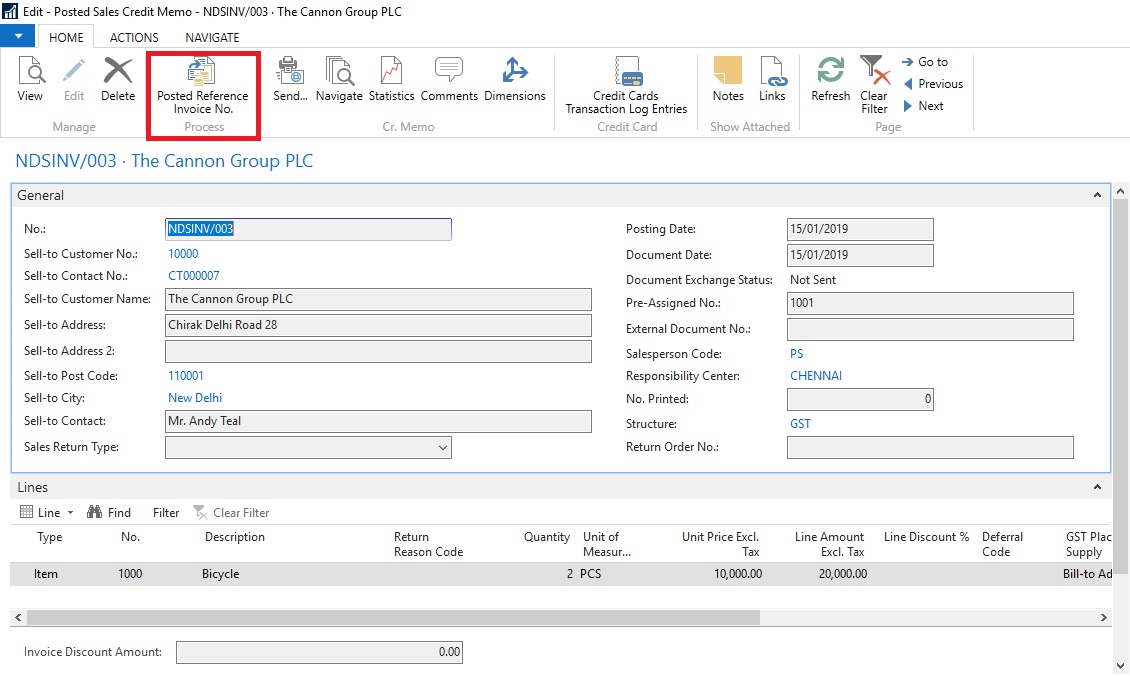

Once you have posted the document system moves the reference invoice nos to posted reference invoice no.

Posted Reference Invoice No

Posted Reference Invoice No